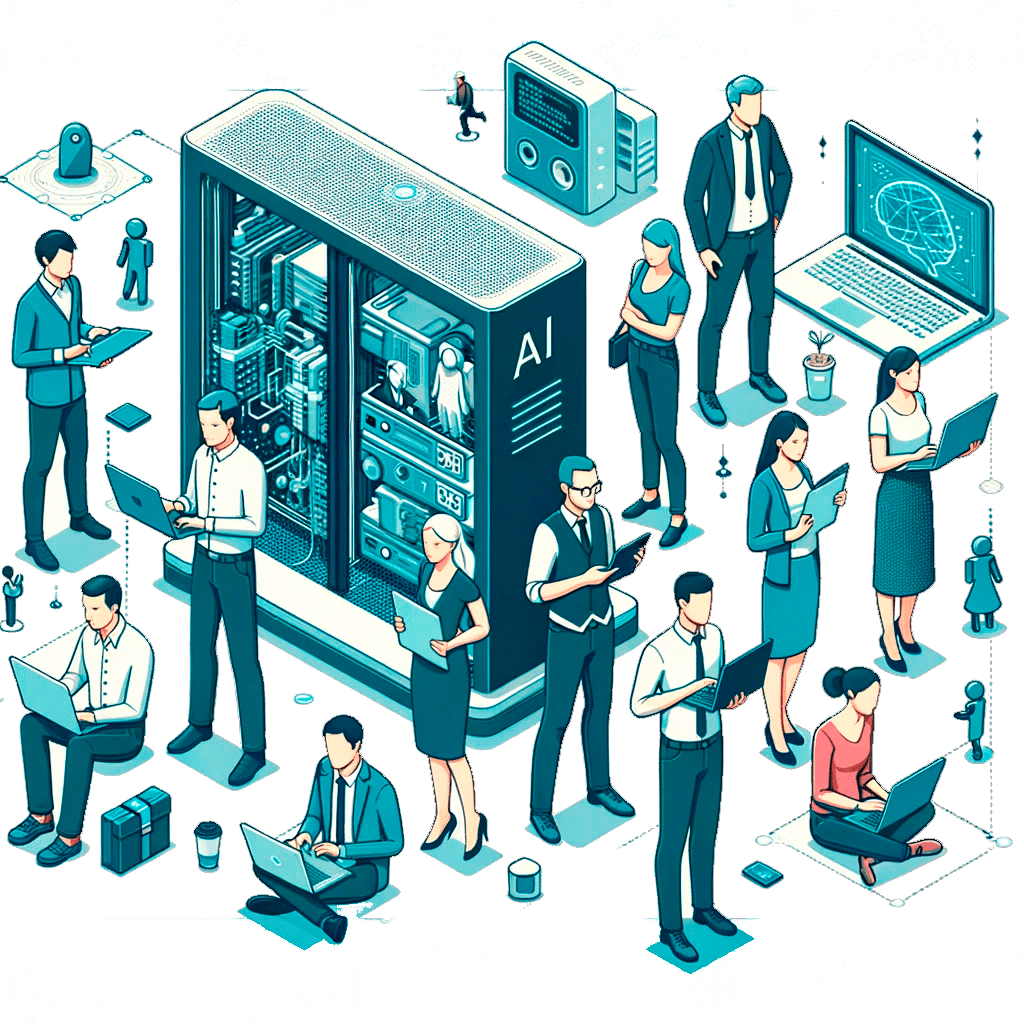

How does Aictuari work?

Either web based or by connecting your apps to our API, boost your decision making with a new way of managing automobile insurance portfolios

1. Aictuari analizes your car insurance portfolio, predicts and suggests optimizations

Easy to connect, easy to use

Manage your portfolio with a new dimension of insights. Predict the future and forecast possible scenarios to optimize your portfolio to your strategic goals

Web based

You don't have to connect your systems to user Aictuari. Upload excel files from your data warehouse to launch experiments with our AI models

Launch predictions

Select from our AI model library the desired profile, aligned with your strategic goals

API available

Connect your core and decision making tools to Aictuari to segment data, launch predictions and obtain our KPI's

Project scenarios

Visual graphs and datatables help you understand the AI projections to maximize your decision making

- Web interface

- Upload datasets and configure AI experiments

- Project future scenarios with powerful graphics

2. Aictuari can connect to your pricing models and quote engines

Optimize your risk subscription and pricing systems online

You can include Aictuari KPI’s in your pricing engines to offer online quotes reinforced with our AI models.

Fine tune your pricing with our predictive models to align new production to your strategy.

Validate your risk hypotheses and include our kpi’s in your risk subscription processes to maximize frequency and loss ratio from the pricing stage.

Data in, KPI out

Analyze new risks with our propietary AI models right in your online pricing algorythms

Re-training capabilities

Re-train Aictuari for specific segments or new lines or business and increase accuracy

API based

Our fast access nodes provide our kpi's without delaying quoting processes

Align risk to strategy

Detect and predict hard to forecast patterns applying our AI models to manage your new risks with a new dimension of factors

- Api provides online quote AI enrichment

- Push data and receive KPIs

- Improve alignment of risk subscription to your strategy

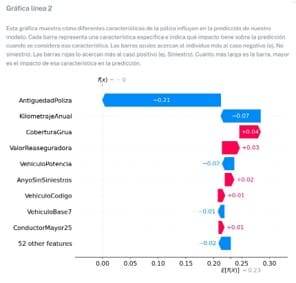

3. Aictuari is not a black-box: all predictions are explainable

Un-biased predictions case by case

- Aictuari’s goal is to predict the future, but all predictions have to be fully explainable

- The system has no bias: it mixes hundreds of variables to provide a final prediction on future claims or profit losses

- The actuary can justify each prediction analyzing the variables in red that have made the prediction possible

Retrain Aictuari with your data and optimize its predictions to your portfolios different profiles

Aictuary has been trained with datasets consisting in millions of insurance data with all possible risk profiles, and adds external data sources. It detects all main risk profiles.

We can retrain Aictuari with your own data to optimize the accuracy of predictions to all your different profiles.